Sky Harbor (SKYH) Initiating Coverage

Despite being relatively under the radar, $SKYH counts among the highest potential specialty real estate companies you can buy

I have initiated a position in $SKYH, and as a standard disclaimer am noting that nothing written below represents investment advice. Please consult your fiduciary prior to making any investment decisions.

Sky Harbour (SKYH) is a Class A real estate company on a mission to build the first nationwide network of private jet hangars. The business earns ~15% unlevered returns on invested capital (investing capital at $300 per rentable square foot and earning $50+ in net operating income per sq. ft.), which is unheard of even when comparing against the most attractive real estate sub-asset classes.

Below are some of the investment highlights for the business:

Demonstrated market potential with demand drivers that are resistant to economic downturns

A straightforward yet innovative business model with clear benefits for customers and airport partners

Business designed for rapid scalability in a large market

Significant entry barriers

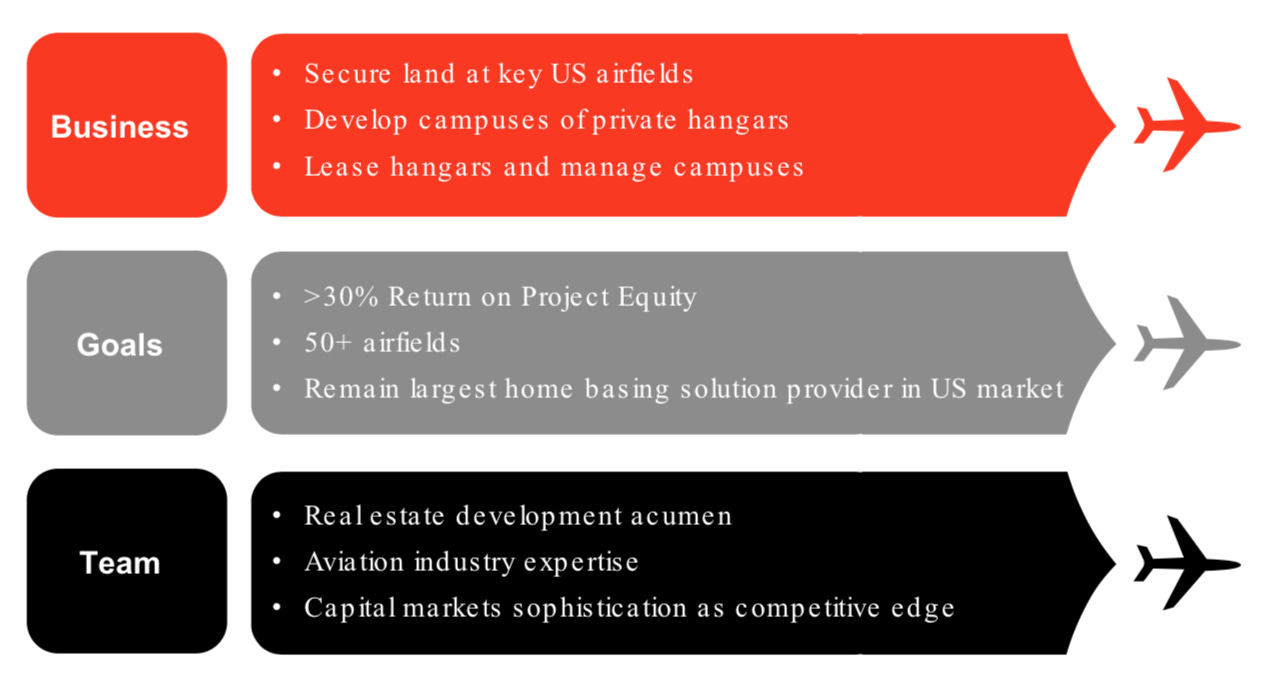

Management team possesses extensive expertise in real estate, aviation, and capital markets, aligning well with the mission

Valuable options for airport land usage beyond business aviation

Appealing opportunity in a rapidly growing sector

History

Tal Keinan, a former Israeli military pilot and founder/CEO of Sky Harbour, conceived the idea for the company when he struggled to find a parking space for his aircraft. This highlighted a genuine gap in the private aviation sector between the growing fleet of private jets and the insufficient number of available hangars.

SKYH 0.00%↑ was brought public in a merger deal with Yellowstone Acquisition Corp, a SPAC sponsored by Alex Rozek, former CEO of the Boston Omaha Corporation and none other than Warren Buffett’s great nephew. It is my opinion that Rozek showcased many of the sound investment principles of his great-uncle by selecting Sky Harbour as an investment. It should also be noted that Berkshire Hathaway owns NetJets, the largest U.S.-based seller of business jet fractional shares. You shouldn’t underestimate the fact that Rozek has unique industry perspective/acumen in the private aviation industry through his relationship to Berkshire’s CEO.

Company

$SKYH’s hangars are located at major airports, typically in areas with high demand for business aviation services. The company builds, owns, and manages these facilities, providing customers with exclusive, dedicated hangar space along with a range of services that may include aircraft fueling, maintenance, and ground support.

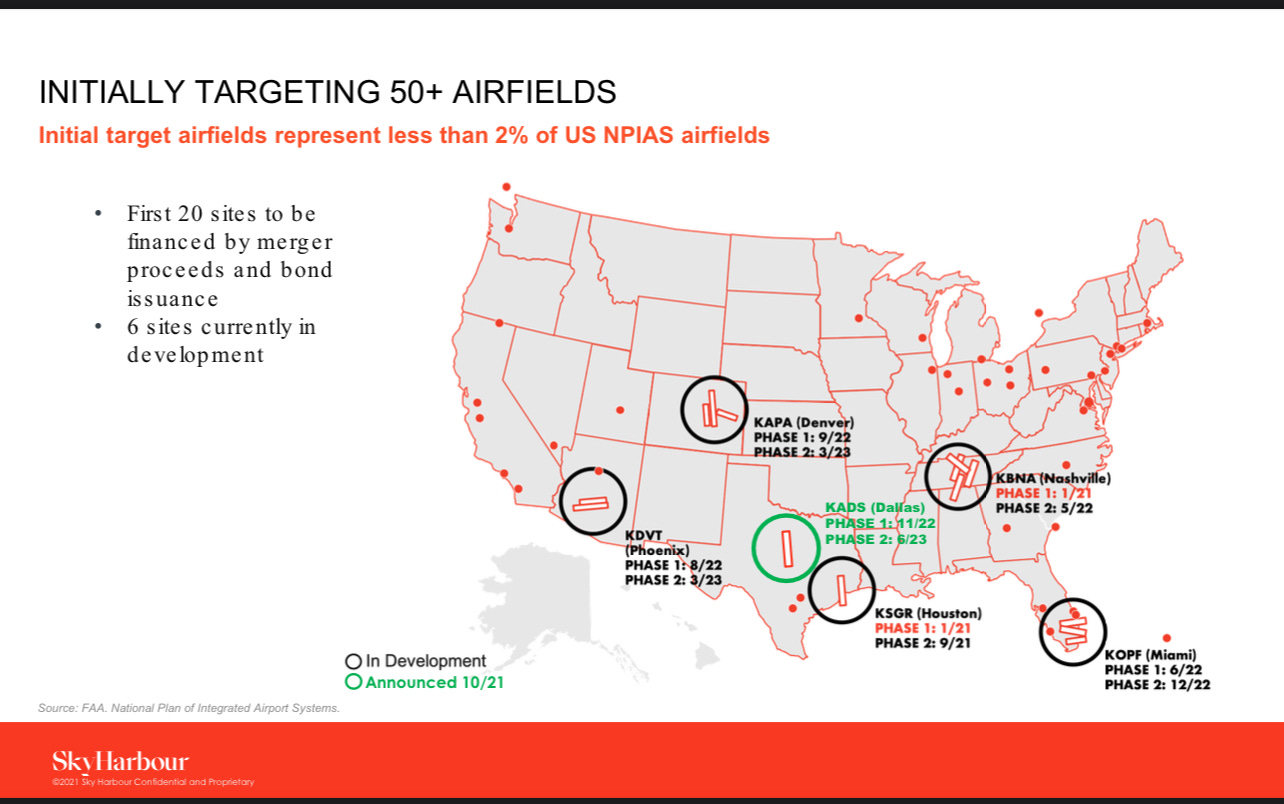

The company is pursuing an aggressive growth strategy by expanding its network of hangar campuses across key markets in the United States. By focusing on markets with strong demand for private aviation infrastructure, Sky Harbour aims to capture a significant share of this niche market. The company plans to develop multiple hangar campuses at strategic locations, including major airports and aviation hubs.

Existing Campuses

Sky Harbour currently has three completed campuses, all with over 95% occupancy:

Sugar Land Regional Airport (SGR), Sugar Land, TX (Houston metropolitan area)

Nashville International Airport (BNA), Nashville, TN

Miami-Opa Locka Executive Airport (OPF&), Opa Locka, FL

The following campuses are in various stages of development.

Addison Airport (ADS), Addison, TX (Dallas metropolitan area)

Bradley International Airport (BDL), Windsor Locks, CT (Hartford metropolitan area)

Centennial Airport (APA), Englewood, CO (Denver metropolitan area)

Chicago Executive Airport (PWK), Wheeling, IL

Hudson Valley Regional Airport (POU), Wappingers Falls, NY (New York City metropolitan area)

Phoenix Deer Valley Airport (DVT), Phoenix, AZ

San Jose Mineta Airport (SJM) San Jose, CA

Stewart International Airport (KSWF), New Windsor, NY (New York City metropolitan area)

Dulles International Airport (IAD), Washington D.C

Orlando Executive Airport (KORL), Orlando, FL

SKYH 0.00%↑ operations can be broken down into three key components:

Site Acquisition: Evaluating markets, choosing locations for campus development, and securing ground leases at top airports.

Development: Building and delivering finished hangars.

Leasing and Management: Leasing out space and offering ongoing management services to tenants.

SKYH 0.00%↑ differentiates itself through their intensive due diligence process. There are two primary questions they ask before building/investing in a market, according to their CEO:

“Given the market rent rates, can we build a campus and still generate double digit yield on cost?”

“What are aircraft paying in fuel margin in that market?”

Unit economics should continue to inflect positively. Mgmt. has indicated that while they are generating ~15% unlevered returns, they expect the NOI yield to top 20% once they develop their next six locations, which they anticipate to be more profitable than their first ones.

SKYH 0.00%↑ is targeting development of a network of 50+ airfields, which it can finance through long-term rental agreements, immune to short- or medium-term fluctuations in fuel prices. This is one major differentiator for SKYH 0.00%↑ compared to fixed-base operators, which have a fuel-based revenue model. Traditional FBOs, which rely on transient air traffic, offer shared facilities. SKYH 0.00%↑’s “Home-Basing Solution” model primarily relies on long-term hangar rentals, where tenants typically enter into staggered 5-10 year leases. SKYH 0.00%↑ also generates revenue by providing ancillary services (they have indicated they are working on one to two dozen add-on services/revenue sources). Although they do offer fuel to their customers, SKYH 0.00%↑ intentionally sells it at a low margin to differentiate themselves from FBOs.

Sky Harbour’s position as a first mover grants it significant competitive edge: with no direct competition, the company can secure ground leases at prime airports without opposition from competitors. Obtaining these leases typically takes ~5 years, meaning any new entrant into the industry would face a lengthy process just to secure a ground lease, followed by additional years for construction and leasing. By the time a competitor becomes viable, Sky Harbour is likely to reach its goal of establishing a footprint at 50+ airports.